2021 ANNUAL REPORT

Download the Annual Report | Download the Audited Financial Report

JEANNIE KILGOUR

Board Chair

RICHARD ADAM

President & CEO

Throughout 2021, despite the continued uncertainty of the pandemic, we have been truly impressed by the vision and commitment of our Board of Directors and employees who embraced the need for change and supported Northern as we commenced work to significantly improve our business, and position the organization for long-term growth and sustainability.

As an organization, we remain grounded in our mission to Make a Difference - for our credit union, our people, and our members, and our focus in 2021 positioned Northern to deliver on that promise. Thank you to our members, for your continued loyalty throughout the year. As your trusted partner, our goal is to always make a positive impact on your financial journey.

At Northern, we are particularly encouraged by the progress to our 2023 goal, which is focused on delivering streamlined and efficient end-to-end processes that will allow us to collectively deliver more efficient and effective services to our members. In 2021, the first step was to implement a new organizational structure, which would bring the right people into the right roles, all focused on delivering the best service to our members. During this time of significant change, our staff remained positive and engaged. This was demonstrated through the results of our employee satisfaction survey, which improved by six points over 2020. The extraordinary actions of our staff were recognized through monthly core value stories that were shared with all staff through our monthly newsletter.

These stories ranged from staff volunteering their time and resources within their communities to providing superior one-on-one support to our members as they managed through difficult situations.

For the first time in Northern’s history, we consolidated six branches across our footprint and permanently reduced hours in other locations. These difficult decisions were necessary to ensure that Northern could continue to modernize our services, keep up with changing member behaviours and industry trends, and ensure our long-term sustainability.

In 2021, we also launched our Community Cooperative Branch Model, in the community of Richards Landing. This is a first of its kind for Northern. Partnering with a local like-minded organization, truly highlights the value and importance of our cooperative principles. Through this partnership, we were able to continue to provide financial services to an underserved market while supporting the local community.

Rooted in our desire to strengthen and build member value and continue to drive engagement for both existing and new members, our goal in 2021, was to continue to remain relevant, improve the banking experience, and enhance core processes. We committed to building a viable organization that would allow us to invest in our members and our communities. In 2021, we rolled out new account packages to provide better options to our members and an opportunity to reduce overall service charges. We also continued to reduce our annual membership dues with the goal to eliminate this service charge in 2023.

In 2021, our members continued to embrace new ways of doing business through technology, as well as through our contact center, which provided them with more options and convenience when they needed it, with increased usage in these digital channels by our members. Recognizing that our members have varying degrees of comfort with technology, in June of 2021, Northern launched the Senior’s Priority Line. This dedicated phone line, complimented by our digital learning series, helped members of all abilities navigate technology and our digital banking channels. Our members also embraced new ways of doing business. “Fred”, our chatbot that launched in late 2020 has now been asked close to 7000 questions, which has resulted in 210 hours of saved time for our staff in the call center – staff who can now use these hours to focus on providing our members with a higher level of personalized advice.

Representing our members, our Board of Directors showed continued resilience, despite another unpredictable year and challenges posed by COVID-19, in setting the direction for the organization and providing strategic oversight. Through the Board’s five Committees: Governance, Audit, Finance & Risk, Human Resources, and Nominating, they carried out their fiduciary obligations. In the fall of 2020, our Board of Directors, and Executive met for its annual strategic planning session, setting the strategic direction that would guide us throughout the year.

In 2021, the Board continued its comprehensive review of its Governance policies and practices that was started in 2020. Specifically, a new Mentorship program was developed with the intent of expediting new Directors’ ability to carry out their fiduciary role with guidance from committed, knowledgeable mentors.

Director compensation was also reviewed to ensure that Directors were properly compensated for their time and commitment and commensurate with the size and complexity of the organization. Board members also continued their personal development journeys with several Board members successfully completing Credit Union Director’s Association (CUDA) courses, which resulted in two Directors becoming accredited and three who will achieve accreditation within 2022.

To ensure that Northern’s Board continually improves and gains insight into their competencies, a new approach to the Director Assessment and Evaluation process was implemented to enhance the process and reflect the needs of our organization and in line with the Financial Services Regulatory Authority of Ontario guidelines and expectations. As well, competency gaps and a new endorsement process were embedded into the nomination process to ensure a continuous improvement in the Board profile and keeping succession planning and diversity a priority.

In 2021, we embraced the challenges that came, and we remained focused on creating a culture of continuous improvement. Building on our strengths and learning along the way, we are confident that we will continue to transform our business to deliver on member expectations and build a sustainable future.

As the result of the successful completion of several projects, throughout 2021, we are now confident that we have the right staff, in the right role, doing the right work. Our branches have been realigned and many of our systems, procedures, processes and policies, particularly related to retail and commercial lending, have been revised and improved such that members are now beginning to experience the benefits of our efforts.

Much work was also undertaken in 2021 to assess our IT capabilities and requirements. This was a critical component of our plan. Although there are significant costs associated with anticipated changes, we are confident that we will achieve efficiencies and cost savings as the result of these changes. In 2022, we will see an increased effort around the improvement and development of our IT infrastructure, analytics, origination systems and payment strategies.

From a financial perspective, the financial implications of COVID in 2020 were expected to continue into 2021. Interest rates remained low, as well as loan demand through much of the year. Higher than usual liquid assets combined with significant competition for loans impacted margin and resulted in a high level of mortgage payouts driving an unusual level of income from mortgage payout fees. COVID restrictions continued to result in cost savings in travel and other related costs. As the year progressed, the economic outlook improved, which had a significant positive impact on our loan provisions. This was driven not only by macro-economic factors but also improved delinquency management and fewer write-offs. Loan demand started to increase in the last quarter resulting in Northern exceeding our loan growth targets by the end of the year. In combination, these events culminated into an unprecedented level of net profit.

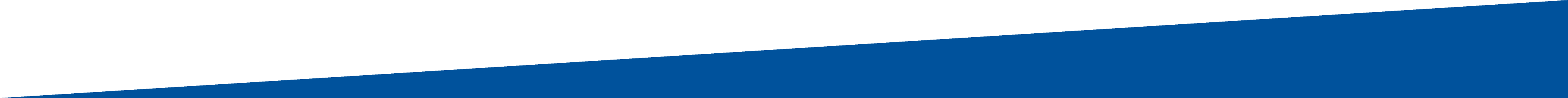

We have a renewed commitment to supporting our communities. Recently, we established the Northern Advisory Committee. This group will consist of a small team of individuals from across the Northern footprint, who are community-driven and want to make a bigger impact in Ontario. Advisors will have a say in the initiatives we participate in, the organizations we support, and how donations and funds are allocated. As well, they will attend events as Northern representatives. Through this program, we will strive to make significant impacts by focusing on a select number of charities and organizations based on the causes that mean the most to us. We will also be seeking opportunities to participate in online initiatives like Ontario-wide fundraisers, and expanding our online presence on social media.

Our employees, who are the “flag bearers” of our cause, championing local initiatives, continue to work diligently to make a difference in the lives of their communities and the people that reside within them. Through our newly developed employee volunteer program, our employees gave back countless volunteer hours to worthy causes in our local communities. In addition, through our staff Win/Win program, we were able to contribute over $12,000 to local charities. As the world moves quickly into a digital environment and fewer members are visiting their branches, the focus on community and building key community partnerships becomes more vital, further extending our philanthropy, community economic development, financial literacy, and environmental sustainability efforts.

As we head into 2022, we are encouraged by what the future holds. Although 2022 will certainly be another busy year with much to accomplish, we are confident that with the support of our Board, employees, and members we will successfully navigate through the changing environment and continue to build a strong Credit Union. We will stay focused on improving our processes and creating a better member and staff experience, while at the same time start to realize the benefits of the changes we have already made. We will build resiliency into everything we do to ensure that we continue to move forward committed to Making a Difference in People’s Lives.

Jeannie Kilgour

Board Chair

Richard Adam

President & CEO

Northern Credit Union Limited’s Audit Committee is a committee of the Board of Directors pursuant to Section 125 of the Credit Unions and Caisses Populaires Act, 1994 and Section 27 of Ontario Regulation 237/09. The committee consisting of five directors has adopted a mandate that comprises all of the duties specified to be performed by Audit Committees in the Regulations to the Act. The Audit Committee is pleased to report to the members of Northern Credit Union that it is functioning pursuant to the requirements of the Act, and that it has fulfilled its annual mandate. The Audit Committee held five meetings during the year and completed the following significant activities:

Served as the liaison between the Board of Directors and the external auditors.

Reviewed and recommended to the Board of Directors, the terms of engagement for the external auditors and their remuneration.

Reviewed and approved the external auditors’ scope and audit plan.

Reviewed the audited financial statement of the Credit Union and recommended their acceptance to the Board of Directors.

Served as the liaison between the Board of Directors and the internal auditors.

Received, reviewed and approved the internal audit scope and plan.

Received and reviewed all Internal Auditor activities and reports.

Received and reviewed reports of regulatory compliance audits, including the Credit Union’s response and progress on management’s action plans.

Held in camera sessions with both the external and internal auditors.

Reviewed the committee’s mandate and annual work plan to ensure compliance with our responsibilities.

Based on its findings, the Audit Committee issues reports and makes recommendations to the Board of Directors or Senior Management, as appropriate, with respect to the matters outlined above, and follows up to ensure that the recommendations are considered and implemented.

The Committee received full co-operation and support from the CEO and Management enabling it to play an effective role in improving the quality of financial reporting to the members and enhancing the overall control structure of Northern Credit Union. The Audit Committee demonstrated a respectful and professional relationship with all parties.

There are no significant recommendations made by the Audit Committee that have not been either implemented or are in the process of being implemented. In addition, there are no matters the Audit Committee believes should be reported to the members, nor are there any further matters that are required to be disclosed pursuant to the Act or the Regulations.

Respectfully submitted,

Max Liedke,

Audit Committee Chair

Audit Committee: John Mangone, Cameron Ross, Peter Beaucage, Kevin Eccles

DIRECTOR |

TERM EXPIRY |

BRANCH |

MEETINGS HELD |

MEETINGS ATTENDED |

| Louise Ahrens | 2023 | Elmwood | 18 | 18 |

| Peter Beaucage | 2022 | Timmins | 18 | 18 |

| Brian Cairns | 2022 | Espanola | 21 | 21 |

| Kevin Eccles | 2022 | Durham | 24 | 24 |

| Tim Foster | 2024 | North Bay | 24 | 24 |

| Jeannie Kilgour | 2023 | Capreol | 27 | 26 |

| Sue Klatt | 2023 | Barry’s Bay | 20 | 18 |

| Max Liedke | 2024 | Sault Ste. Marie | 21 | 18 |

| John Mangone | 2022 | Sault Ste. Marie | 22 | 22 |

| Lori Martin | 2023 | Long Lake | 18 | 17 |

| Daniel McCoy | 2021 | Wawa | 24 | 24 |

| Cameron Ross | 2024 | Thessalon | 24 | 22 |

At Northern, we promise to Make a Difference in People’s Lives. This applies to everyone across our footprint, including our valuable employees. We are committed to equipping employees for future roles in the organization by showcasing their strengths and growing their skillsets.

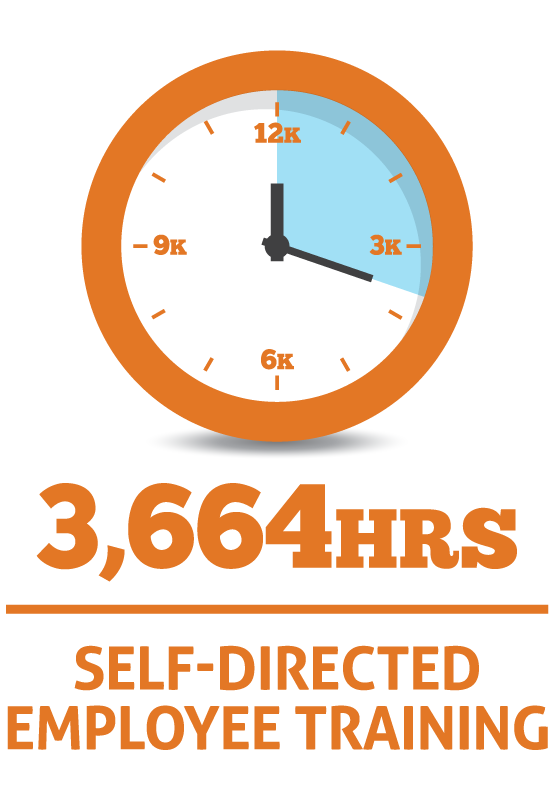

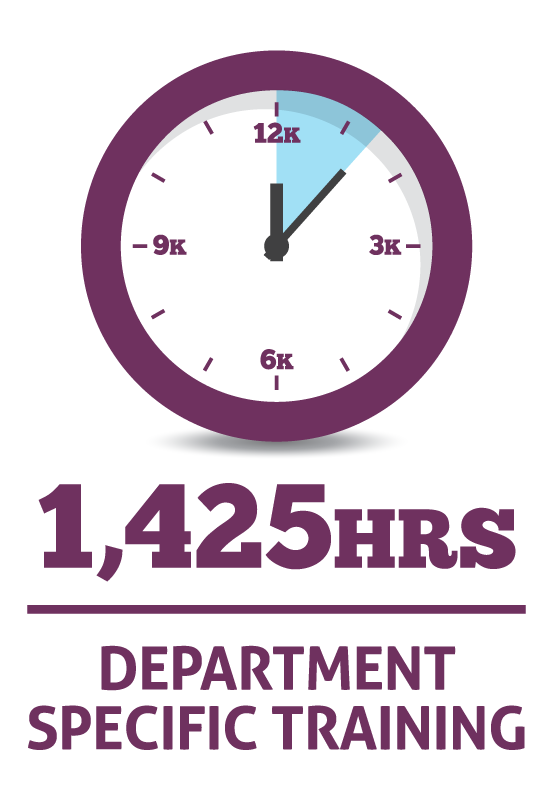

Our training team provided over 6,095 hours of training to our employees in 2021. 3,664 hours of self–directed training was provided to both new and existing Northern employees. With the launch of our new appointment booking software, our employees attended a collective 954 hours of guided training to ensure increased productivity and enhanced employee performance. An additional 1,425 hours of department-specific training took place in areas such as lending, insurance, and human resources.

At Northern, we strongly encourage employee teamwork and feedback when it comes to improving our processes, which is shown throughout numerous initiatives in 2021. In 2021, we held optimization summits to improve the overall member experience in key areas of our business such as personal and business lending and branch processing. Employees of all levels of our business spent a total of 1,728 hours in summits, evaluating our operational systems and providing insightful recommendations. At Northern, we believe that our employees play a vital role in achieving operational excellence. Inviting employee feedback has allowed Northern to make better, more informed decisions that make a lasting difference for our employees, members, and our business.

“As someone in administration for member services, it was exciting to be able to see a different perspective and discuss with my peers across the footprint what improvements can be made that helps the organization as a whole.”

Michelle Menard,

Special Services - Finance

Building a positive workplace culture is an important part of Northern’s success. We encourage our employees to be engaged, be inspired, and help make Northern a great place to work. The Northern Rangers group was introduced in 2021, as a troop of Northern employees who meet to discuss key organizational initiatives, act as advocates for organizational changes and promote a positive workplace culture through fun activities.

In 2021, the Northern Rangers carried out weekly initiatives, which allowed staff to take a few minutes out of their busy work week to engage in fun activities and connect with their coworkers who live in different communities across our footprint. In addition, the Northern Rangers helped to launch our employee WIN/WIN Payroll Donation Program that supports worthy causes that are important to our employees and launched our Do Some Good initiative that promotes employee volunteerism and social giving.

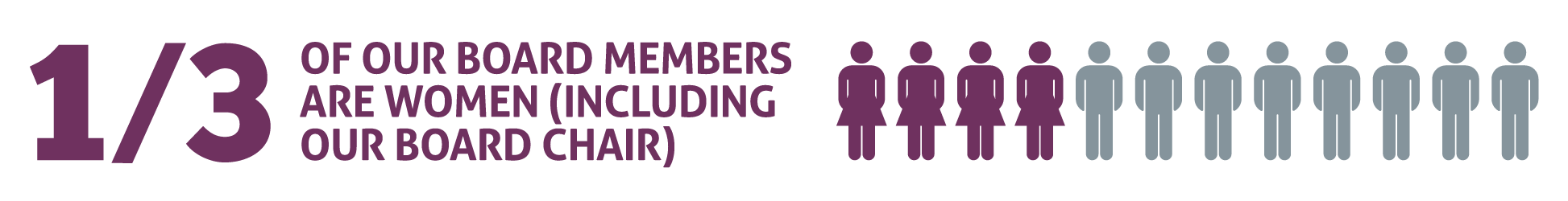

In recent decades, society has made strides to analyze the importance of women in business leadership roles. From research, we know that having women leaders in a business directly impacts an organization’s bottom line. In fact, for every 10% increase in gender diversity, organizations will see their profits rise by an average of 3.5% 1. Women bring unique skillsets to a business, like imagination and creativity, along with cultural differences to grow an organization’s diversity. It is important for Canadian women to step up into leadership roles. We learn and build resilience through practice and experience. The representation of women in business today will give future generations of women the courage and confidence to step up as leaders, advancing society and reduce gender norms as we know them. At Northern, we believe that by recognizing, respecting and valuing everyone’s differences, we can create a truly inclusive culture.

1 Hunt, V., Layton, D., & Prince, S. (2015). Why Diversity Matters. Retrieved 9 March 2022, from https://www.mckinsey.com/business-functions/people-and-organizational-performance/our-insights/why-diversity-matters

Director of Sales

I was inspired to step into a leadership role at Northern because I wanted to positively influence others, create a positive work environment and be a change advocate. I wanted to share my knowledge and lead people and teams to success.

More women leaders will also influence the high-level decision-making that will pave the way toward gender equality. My most incredible mentor and leader is a woman, and I’m a great leader because of her!

Market Manager for Thessalon, Elliot Lake and Espanola

I enjoy seeing my team members learn and grow professionally in their roles, and having the ability to be part of their growth is what inspired me to take on this leadership role.

At the end of the day, by having more women in leadership positions, you’re setting them up to be brilliant mentors of the next generation of women leaders, and that is what I hope to do for the next generation.

Senior Vice President & CFO

Leading a team has provided me with the opportunity to have an impact not only on the individuals within our team but across the organization. Seeing the growth and development of team members is exciting and rewarding, especially when those individuals grow and step into leadership roles.

For me, being a leader is important because I want to be a role model for my daughter and encourage her to be confident and not afraid to make challenging decisions.

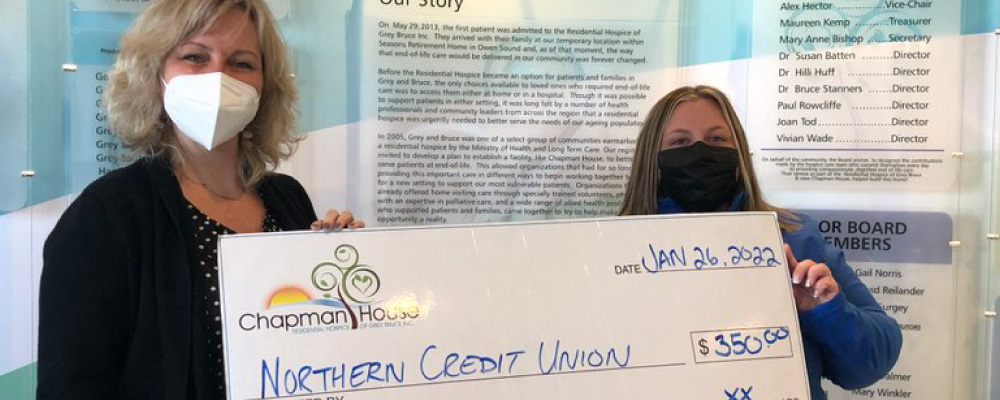

We are committed to creating a diverse workforce, that provides opportunities for everyone to grow and prosper. We have a strong representation of women in key leadership roles in our organization.

Did you know that 88.8% of all Northern staff members are women? To break it down, 75% of our executive team, 58.9% of our department leaders, 96% of our market managers, and four of our board members, including our Board Chair, are intelligent, mighty women. We are proud to recognize all of the powerful women who make Northern a strong, dynamic organization. We hope that we can continue to influence young women in our communities to be the next generation of leaders. To all of the hard-working women at Northern Credit Union, you make us True North Strong.

At Northern Credit Union, our members are more than just a number. Our members are owners, and through our member elected Board of Directors they impact the strategic direction of our credit union. We proudly serve our members with personalized financial expertise to suit their unique situations. Member attraction and retention are key indicators of the trust and confidence our members have in Northern.

In 2021, we welcomed 12,653 new members to Northern. This brought our total to 73,273 members who we can positively impact by providing that ‘WOW’ experience. Of these new members, 298 are businesses that have chosen to partner with Northern because we understand the importance of small businesses in our local communities, economy and culture. In total, we have 4,081 business members across our footprint who benefit from expert advice and guidance at all stages of their business.

Our members choose Northern because we make their needs a priority, and offer the most tailored financial services and advice for their circumstances. More importantly, we prove that we are True North Partners to the communities we serve by going above and beyond. For our personal account members, this may mean guiding them through every step of their home-buying journey. Offering a convenient online pre-qualification tool, an informational Home Buyers Guide, and one-on-one advice from educated Northern advisors, we are there through it all. To our business members, it could mean that we assist in building their business from square one. Between our Small Business Guide, online tools, personalized lending options, Northern Business Visa credit cards, and Business Relationship experts, Northern business members have all of the necessary tools to open and operate a successful business. These are just two of many examples of how we step up to make a lasting impact for our members.

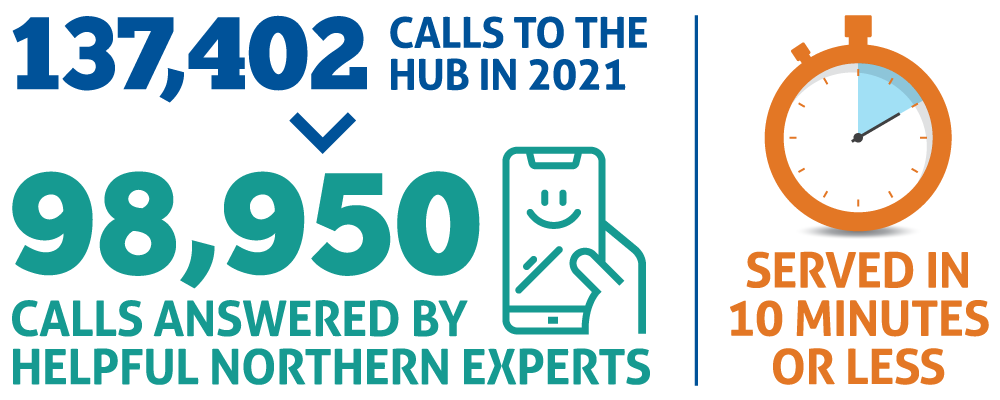

The True North Hub serves our members as a helpline for all inquiries about their Northern products and services. Located in Sault Ste. Marie and Pembroke, the True North Hub is staffed with Northern experts who provide financial advice, organize appointments, and resolve/manage important issues our members have.

In 2021, 137,402 calls came into our True North Hub phone line. Of these, 98,950 were answered by a Northern expert who helped the caller navigate important financial questions and concerns. Callers experienced a short wait time of three minutes and had an average handle time of five minutes. In less than ten minutes, our True North Hub experts were able to serve our members. Throughout 2021, we introduced several strategies to make the True North Hub more accessible to our members and to boost their financial literacy. Firstly, we integrated a Senior’s Priority Line that flags calls from seniors as high-priority. In addition to financial experts, the Hub staff managing the Seniors’ Priority Line are trained in how to best support seniors. We understand that technology can be difficult to navigate, so our Hub staff takes the appropriate time and measures to educate seniors on available resources and extend their assistance with a follow-up email. This line allowed us to better serve 467 of our senior members. We also recognized the need for a digital knowledge center to ensure members of all abilities are comfortable with online and telephone banking and provide them with basic banking tips. We also created the Northern Know-How web page, packed with videos, articles, and graphics, to easily educate our members on digital banking, financial tips for retirement, and how to prevent fraud while banking online. Northern Know-How is a user-friendly, simple-to-navigate resource to keep our members connected and confident when it comes to accessing their finances.

Almost all banking, including account setup and inquiries, bank transfers, investments, loans, lines of credit, and mortgages can all be done using Northern Credit Union’s online and telephone services.

To show our firm commitment to our members and local businesses, we partnered with Celero Solutions to introduce the Aura Loyalty Program. Transitioning from the Northern Promise Loyalty Program, we initiated an alternative solution to put money back into the pockets of our members and local businesses. Aura Loyalty is a member-exclusive digital rewards program powered by a free, no-fee, re-loadable Mastercard® and the Aura Loyalty app. Members who sign up for our loyalty program will enjoy instant cashback on purchases made with their Aura Mastercard®, and gain access to exclusive offers, benefits, and money management tools. Local businesses also benefit by setting up exclusive product and service offers on the Aura Loyalty app, which will encourage users to shop local. The Aura Loyalty program is a step forward in exceeding the expectations of our

At Northern, we are loud & proud True North Partners. We show up for our communities at every possible opportunity. In 2021, we ensured that we stood by this mantra through several initiatives.

Northern introduced the Community Trailblazer program to ensure that employees are engaged in our communities. The 21 Community Charity Kickoff set the stage for the Trailblazers by donating $12,600 to worthy causes in the communities we serve. One employee from each of our 21 communities was randomly selected to choose a local charity to which a $600 donation would be made. Our employees chose to donate to local health centers, animal shelters, social justice initiatives, Salvation Army, and Lions Club, to name a few.

Another part of the Community Trailblazer program that our Northern Ranger group initiated was the Win\Win Payroll Donation program. Employees can choose to opt-in for $3 per pay and are entered to win a monthly draw. Each month, a portion of the payroll donation supports a local charity, of their choice, and the remainder of the donation supports ongoing fun initiatives within the organization. This is truly a Win/Win situation, as it promotes a fun positive work environment while supporting worthwhile local causes in our communities.

Finally, the last part of the Community Trailblazer program that launched was the Do Some Good Volunteer program. With this, we are encouraging Northern employees to get involved in their communities by allowing for three hours of paid volunteer time per year/per employee. If an employee completes their three hours of volunteer time within the year, Northern will donate $100 to a charity of their choice. With the Do Some Good Volunteer program, we introduced our employees to DoSomeGood.ca, an online platform to log and track their volunteer hours and post photos of their community involvement. Community partners can also join DoSomeGood.ca to connect with Northern employees about upcoming volunteer opportunities in their areas. This innovative platform allows Northern to connect with like-minded community driven organizations within our footprint to support their fundraising initiatives and make a lasting difference for all.

We are happy to have supported the Ontario Credit Union Foundation (OCUF) Bursary Program once again in 2021. We asked our employees to make a monetary donation to any charity of their choice, and Northern doubled their donation amount in support of the OCUF Bursary Program.

In total, Northern employees donated $1,000 to local community initiatives, and Northern Credit Union donated $2,000 towards the OCUF Bursary Program. This donation sponsored CU Succeed Youth Bursaries, which are awarded to post-secondary students who are Ontario credit union Members, or who have parents belonging to an Ontario credit union, and require financial assistance to pursue their academic, vocational, or technological training.

Northern Credit Union members Madeline and Ivorirose were the 2021 recipients of CU Succeed Youth Bursaries. Both Madeline and Ivorirose received bursaries of $1,000 from Northern to support their educational pursuits. We are excited to continue our support of the OCUF Bursary Program in 2022.

At Northern, we understand that the holiday season can be financially and emotionally daunting for some families. The 12 Days of Giveaways – Making Spirits Bright campaign ran throughout December, aiming to bring some financial ease and make a lasting impact on 12 deserving families across our footprint.

We asked our communities, whether they are Northern Members or not, to nominate deserving families in need of a little extra help throughout the Christmas season. Of these nominations, we supported 12 families, from across our footprint, who received a Christmas dinner basket of non-perishable food items, a $250 PC grocery gift card, and a $500 deposit into a Northern Credit Union investment account.

Through this worthy initiative, we were able to help families who have experienced difficult illnesses, unthinkable loss, and financial troubles, by giving them just a glimmer of hope and joy during the holiday season. In addition, we were able to help contribute to a more financially stable future.

As an organization, Northern Credit Union’s core purpose is to Make a Difference in People’s Lives. Making that difference means we follow our core values; be a True North Partner, be member-focused, get stuff done professionally and with integrity, and own our growth.

Based on the successful and admirable initiatives that Northern implemented throughout 2021, we can confidently say we lived our purpose. We are excited to continue to live our purpose and make a lasting difference for our members, our employees, and your Credit Union throughout 2022.

Interested in learning about Northern or our products?

© 2021 Northern Credit Union, Limited. All Rights Reserved